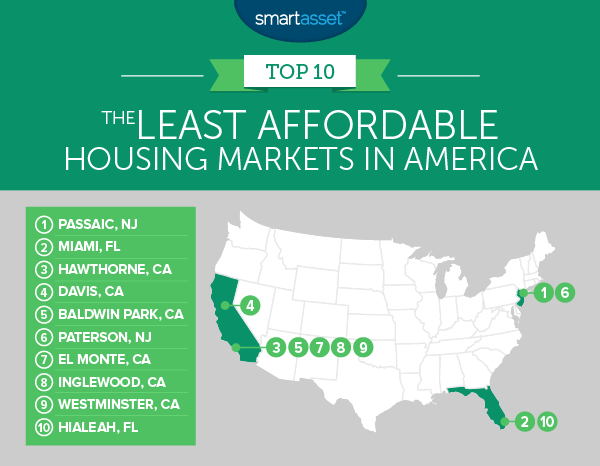

Paterson and Passaic City among least affordable housing markets in U.S., study

By Jonathan Greene

Published: July 27, 2017

The housing market in Paterson is the sixth least affordable in the United States, according to a new study released by New York City-based personal finance firm SmartAsset. The situation is far worse in neighboring Passaic City which ranks first place as the least affordable housing market in the country.

Residents in both cities face enormous difficulty in affording housing. For example, the study found on average renters in Paterson spend 44-percent of their income on housing while in Passaic City renters spend 50-percent – highest in the U.S.– of their income on rent.

The Department of Housing and Urban Development (HUD) generally recommends a spend family 30-percent or less of its income on housing. Families spending over 30-percent of their income on housing are considered “cost burdened” and have a tough time “affording necessities such as food, clothing, transportation and medical care,” according to HUD.

The culprit in Paterson is stagnant or declining household income. “We found that the least affordable housing markets are often cities where incomes have not risen. From 2011 to 2015, rents in Paterson remained the same, but the average household incomes dropped, from $32,400 per year to $31,500 per year, worsening the housing cost burden for residents,” A.J. Smith, vice president of financial education for SmartAsset, said.

The culprit in Paterson is stagnant or declining household income. “We found that the least affordable housing markets are often cities where incomes have not risen. From 2011 to 2015, rents in Paterson remained the same, but the average household incomes dropped, from $32,400 per year to $31,500 per year, worsening the housing cost burden for residents,” A.J. Smith, vice president of financial education for SmartAsset, said.

The picture is not much better for homeowners. Homeowners in Paterson on average spend 44-percent of their income on housing expenses while in Passaic City housing cost ate up 53-percent of a household’s budget.

When families spend so much of their income on housing they tend to cut costs in areas like food and healthcare at the detriment of the local economy. “This reduced spending impairs the household’s quality of life and can be a drag on the local economy. Additionally, these families have less money to secure their financial future (saving for retirement) or meet other financial goals (saving for their child’s education),” Smith said.

The study focused on uncovering least affordable housing markets in America and did not research local solutions to addressing the issue.

“The silver lining for Paterson residents is that the city has the second-lowest home value to income ratio in our top 10. Therefore, buying a home is slightly less out of reach for the average Paterson household compared to average households in other unaffordable housing markets nationwide,” Smith said.