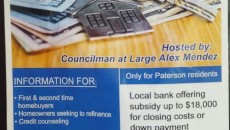

Councilman Alex Mendez took heavy fire from one of his colleagues on Thursday night for distributing a flyer described as “misleading” that advertised a so called “financial relief workshop” offering thousands of dollars in home purchase subsidies to residents.

Mendez’s flyer did not mention the workshop was an outreach event by Buffalo-based M&T Bank which is offering homebuyers in majority black and Hispanic neighborhoods more than $10,000 in down payment and closing assistance to comply with a consent order. It also identified the lending institution as a “local bank.” M&T Bank does not have a branch in the city; however, there’s plan for a branch in downtown Paterson.

Velez said the flyer is “misleading the community.” The flyer promises financial relief, but the bank is offering loans, he said. “If you’re getting a mortgage or a second home that’s not financial relief that’s debt,” said Velez.

Mendez said he called the event a financial relief workshop because the money does not have to be paid back. He told his colleagues he met with an executive of the bank four months ago to arrange the workshop to encourage locals to take advantage of the subsidy program. His flyer did not mention the subsidy program was being run by the M&T Bank.

“I left their name out just to protect the company,” said Mendez. Velez suggested leaving out the company’s name gave the impression Mendez’s campaign was facilitating the process which would naturally help the mayoral candidate gather voters’ support for his upcoming run.

Mendez’s flyer has his 2018 mayoral campaign insignia without the required “paid for by” label. New Jersey election law requires candidates to clearly label campaign materials.

Mendez said over 300 families attended the event at the Paterson Museum in late May. He said some received $11,000 to $18,000 in subsidy from the bank.

The two men’s political dispute entangle an unsuspecting rookie loan officer at the bank. Tomasz Lopata, who came before the city council to make a presentation on the subsidy program, was grilled by Velez.

“You never saw this flyer?” asked Velez.

“Never,” replied Lopata.

The flyer was not approved by the bank, said Lopata, who has been working for the bank for the past year.

Velez asked Lopata whether the bank will condemn this political flyer. The loan officer indicated that’s above his pay grade.

Mendez urged his colleagues to help promote the program that’s aimed at benefiting residents. The program was imposed on the bank by former president Barack Obama’s administration which found Hudson City Savings Bank refused to lend money to people in minority neighborhoods.

Hudson City Savings Bank engaged in discriminatory redlining denying fair access to mortgages for people in majority black and Hispanic neighborhoods in New York, New Jersey, Connecticut, and Pennsylvania, according to the Consumer Financial Protection Bureau.

The Bureau and the Department of Justice sued Hudson City Savings Bank for its practices and secured a consent order. Hudson City Savings Bank was forced to pay $27 million in mortgage subsidies and outreach programs. It was also assed a $5.5 million penalty.

$25 million of that money was set aside for direct loan subsidies for communities that were 50-percent or more Hispanic or black in the four states. $11 million of that money is still available. $3 million is reserved. And $8 million will be issued in direct loan subsidies, according to the loan officer.

“We allege that Hudson City’s redlining practices illegally cut off opportunities for consumers in predominantly Black and Hispanic neighborhoods to get a mortgage and achieve the dream of homeownership,” Richard Cordray, director of the Consumer Financial Protection Bureau, said in late 2015. “Without access to affordable credit, neighborhoods deteriorate in the long shadow cast by unfair lending.”

M&T Bank acquired the allegedly racist Hudson City Savings Bank of Paramus in 2012. As a result, the successor bank has to comply with the consent order.

For more information about the subsidy program visit the bank’s website by clicking here.

Email: [email protected]