I have read the letter from Mr. Pedro Rodriquez regarding the Paterson Reassessment Program which is currently ongoing. I would just like to clear up some misconceptions which I noticed in the letter and advise the taxpayers of Paterson some of the true facts about the reassessment program.

First of all, it is a reassessment, not a revaluation program. The reassessment program is a program to legally keep a rolling and up to date assessment which reflects current market values for that pretax year. Other facts as follows:

- The annual reassessment program will not negatively affect the homeowners. In fact it will help bring more ratables into the tax rolls for the City as well as reflecting the true current market value of all properties in the City, further helping to distribute the tax burden equally and fairly amongst the property owners.

- The annual reassessment program is advantageous in both a declining and increasing market. As the market increases, so will the assessments annually, improving ratables and reducing the overall tax rate. Again reflecting current market values for all property owners. Should the market decrease this will also be reflected in the annual assessment and allow citizens to be taxed fairly and not at higher values.

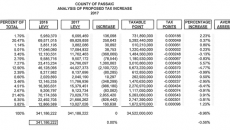

- According to the Passaic County Board of Taxation, all remaining towns which have not performed a revaluation are targeted for a revaluation going forward. Also the State Treasury Department does reflect an adjustment for those towns which have not performed a revaluation in their final calculations. As of the 2017 County Analysis Paterson’s tax leg has declined for 2017. See analysis from county.

- I agree with the writer of this letter, that the foreseeable trend going forward would indicate increased property values along with an increasing economy which should be good for everyone, creating new and better paying jobs. The writer tells about a statistic from Movoto.com and speaks of an average list price. Listing prices are not actual sales prices. List prices are not indicative of true actual values because anyone can list a property at any price, and it does not have to be a true reflection of market value. So to rely on this as an actual fact of a trend that is taking place, would be incorrect and misleading to the public.

But to further provide factual data, as of public records, the assessed value for Paterson average residential values in 2016 was $192,492 and the assessed value for Paterson average residential values in 2017 was $185,024. This displays a reduction in assessed values over the past 2 years.

As I have said, as the economy improves, so will the jobs and lives of all in the City of Paterson. But be assured that the assessments will reflect this improvement as well, which ideally should reduce the overall future tax rates and allow everyone to fairly share the burden of taxation.

As a precaution to the taxpayers having tax appeals filled out by persons who are not professionals or experts in the tax appeal processes may result in a poorly executed appeal form with unusable market information and false hopes of an assessment reduction. An expert may be able to advise you on whether or not you should spend your valuable time to take a tax appeal or not.

Richard Marra

Tax assessor for the City of Paterson