City officials approved a 30-year tax abatement and a redevelopment agreement with Medical Missions for Children on Tuesday evening despite recent announcement by St. Joseph’s Regional Medical Center that it is uninterested in having a hotel and conference center on its property.

The redevelopment agreement stipulates the developer must employ 15-percent of the project’s construction and post-construction workforce from Paterson. It prescribes the developer to award 15-percent of the contracts to local companies during construction and after completion, according to the agreement.

“This seems a little disappointing to me,” said Michael Jackson, 1st Ward councilman, looking at the numbers. He wanted a higher percentage of construction contracts to go to local businesses.

Representatives of Medical Missions said the 15-percent is the minimum, the number could be much higher.

“We tried very hard to address” your concerns, said Steve Mairella, attorney for the developer.

Jackson’s insistence earned him a rebuke from his colleague Julio Tavarez, 5th Ward councilman. “It’s politically popular to shake down developers. We’re adding more hurdles to a project that’s almost not happening,” said Tavarez.

Council president William McKoy thought “shake down” was an inappropriate term to describe the council’s demands for more jobs and contracts for local businesses.

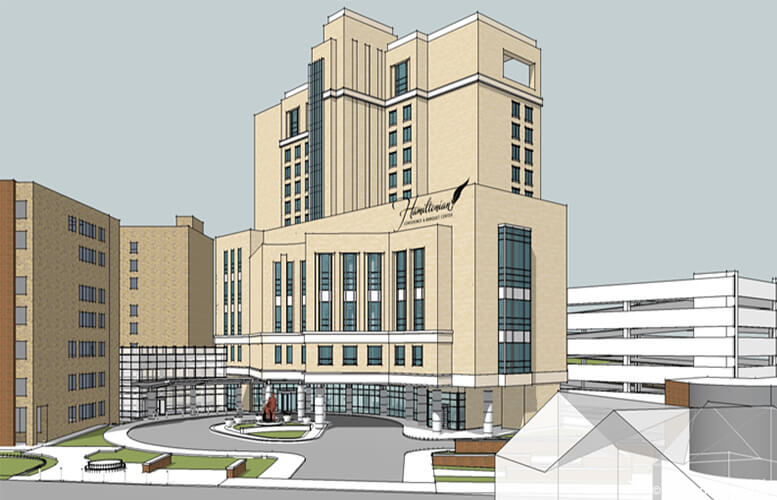

“Majority of the changes have been made,” said McKoy, who also pressed the developer hard few weeks ago to provide a guaranteed percentage of jobs to local residents. The $129 million hotel project will create 490 construction jobs and 257 permanent full-time jobs upon completion, according to the developer.

Jackson argued the city is providing the developer a great deal of incentives and deserves to gain jobs and contracts for residents and local businesses in return.

Council members gave final approval to a 30-year payment in lieu of taxes (PILOT) agreement.

The city will receive an average of $666,000 per year in taxes under the agreement. If the 14-story hotel conference center was in full taxation, at 4-percent tax rate, it would pay $2.4 million per year, according to estimates.

Before any of the agreements were approved the council sought re-assurances from its attorneys and the developer in connection St. Joseph’s announcement last Tuesday. The hospital said in the announcement it is uninterested in the hotel project citing financial problems and viability of the project.

The hospital also said the 99-year lease for the site where the hospital is to be constructed between the developer and the hospital was never approved by its board of trustees. The board passed a resolution six months ago expressing reservations about the hotel project.

“That issue should not color the action of the council tonight,” said Jean Cipriani, city’s redevelopment counsel. She said the city risks losing the $105.5 million Urban Transit Hub Tax Credit Program credit issued for the project by the New Jersey Economic Development Authority (EDA).

“It’s our best shot to hold on to those tax credits,” said Cipriani. She said if Medical Missions prevails in court against the hospital it could quickly secure financing with the tax abatement agreement in place. If the hospital prevails then the city would have done its part in progressing the project and could argue to the state the project died at no fault of its own to apply the tax credit to a different project, she said.

“Our best chance of convincing the state in any form is to show the city is committed to pursuing the project,” she said.

North Haledon-based attorney Harold Cook, who is involved in the lease agreement dispute between the hospital and the developer, said Medical Missions, a nonprofit that provides entertainment for sick children, has a strong case.

“Every step of the way representatives from the hospital were involved in this project,” said Cook. He said last year the hospital’s representatives were involved when an issue emerged about the project’s financing.

None of them raised any issues about the lease, he said. McKoy asked Cooke, who represents Medical Missions, if he is aware that the agreement was never approved by hospital’s board of trustees.

“If you were a director or trustee at the hospital and you were not aware of what was going on you were in a vacuum,” said Cook. He held up a newsletter issued by the hospital that touts a hotel “coming soon” at the hospital.

“To say the board did not have knowledge of this – if they did not have knowledge shame on them. If they had knowledge and didn’t try to stop it early on after all this money was expended by the developer shame on them,” said Cook.

The hospital’s former president William McDonald entered into a lease with Medical Missions in March 24th, 2014. The resolution passed by the trustees in January of this year expresses concern about the impact the lease will have on the hospital’s tax exempt status given that the land is being provided to an unrelated party for less than a fair market value.

“They put us in a box,” said Frank Brady, president of Medical Missions, about the hospital’s position.

Brady has said his organization spent almost $20 million on pre-construction costs.

“We hope they’ll comply with the lease,” said Cook. “We’re willing to have discussions.”

Email: [email protected]